Tax Deduction For Home Office 2024. The home office deduction lets you deduct a portion of your home expenses to reduce your business taxes owed. There are three basic requirements for claiming the home office deduction:

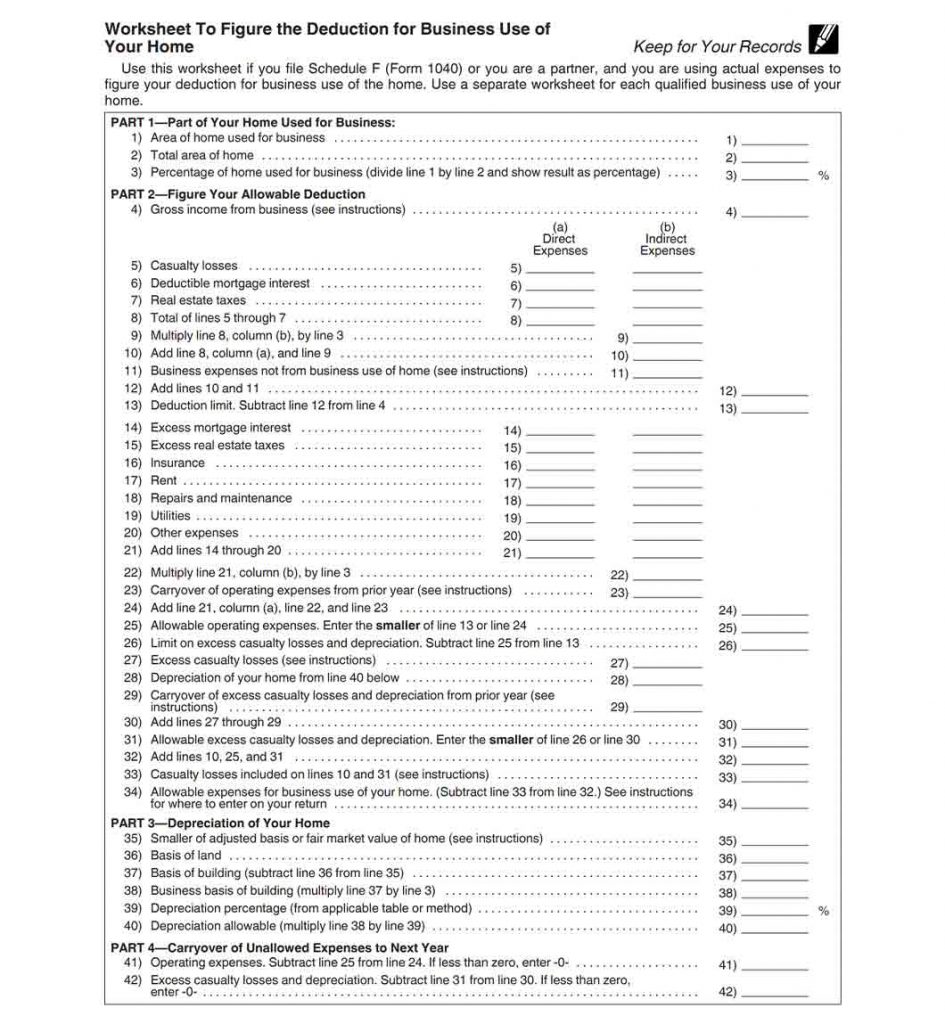

It’s important to understand which expenses you can deduct in 2024 and how to calculate the deduction accurately. Simplified method for business use of home deduction.

The Home Office Deduction Is Also Easy To Miss.

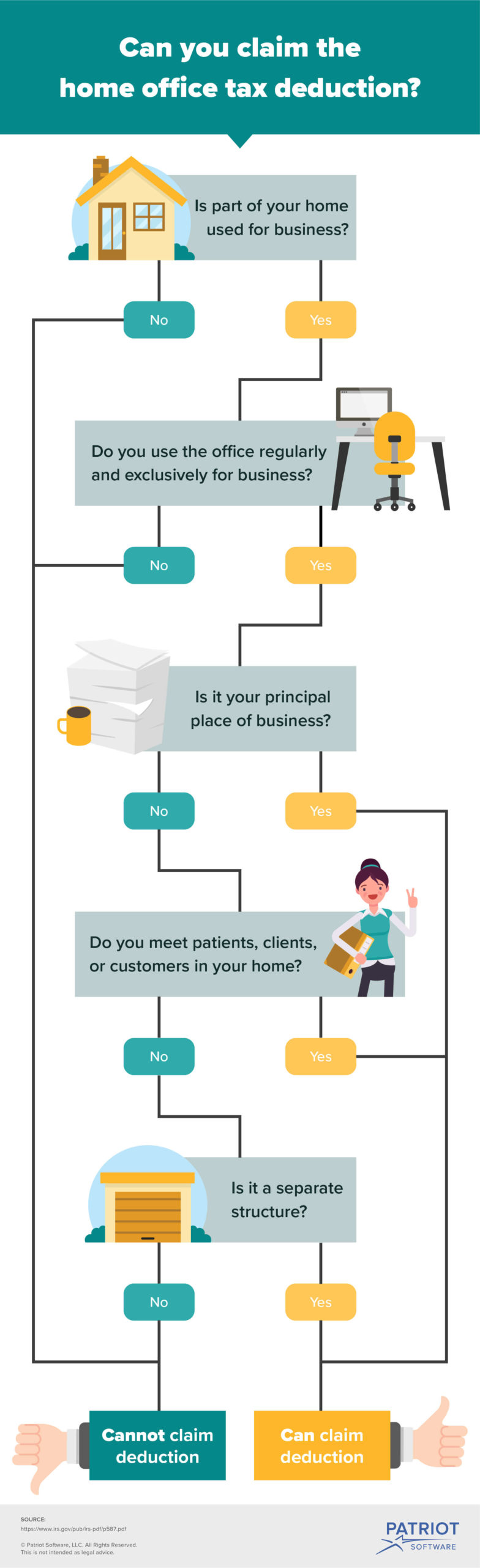

To qualify for a home office deduction, your living space must meet two criteria:

March 28, 2024 Tax Deductions.

The home office deduction lets you deduct a portion of your home expenses to reduce your business taxes owed.

The Irs Guidelines For Home Office Deductions Are An Important Aspect To Consider When Preparing Your Tax Returns For The 2024 Tax Year.

Images References :

Source: www.fastcapital360.com

Source: www.fastcapital360.com

Home Office Tax Deduction What to Know Fast Capital 360®, 2) since there were no changes announced in the interim budget presented by finance minister nirmala sitharaman on february 1, 2024, the standard deduction for. There are three basic requirements for claiming the home office deduction:

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Home Office Tax Deduction What Is it, and How Can it Help You?, If you have a dedicated home office for your business, $5 per square foot can be deducted. The home office deduction is also easy to miss.

Source: mployme.blogspot.com

Source: mployme.blogspot.com

How To Get Tax Deduction For Home Office MPLOYME, You can use the home office deduction whether. If you have a dedicated home office for your business, $5 per square foot can be deducted.

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

Home Office Tax Deduction What Is it, and How Can it Help You?, You can no longer claim the deduction as of tax year 2022. If you only use that.

Source: blog.hubcfo.com

Source: blog.hubcfo.com

Simplified Home Office Deduction, There are three basic requirements for claiming the home office deduction: It must have an area.

Source: www.hellobonsai.com

Source: www.hellobonsai.com

FREE Home Office Deduction Worksheet (Excel) For Taxes, Dec 13, 2022 5 min. Fill in the applicable form.

Source: www.mmsgroup.co.za

Source: www.mmsgroup.co.za

Tax deductions for Home Office Costs MMS Group, March 28, 2024 tax deductions. In this article, we’ll reveal the eligible expenses and provide.

Source: americanlandlord.com

Source: americanlandlord.com

Home Office Tax Deduction for Landlords American Landlord, To qualify for a home office deduction, your living space must meet two criteria: March 28, 2024 tax deductions.

Source: jasciante.blogspot.com

Source: jasciante.blogspot.com

How To Calculate Home Office Tax Deduction OFFICE, It must have an area. There are three basic requirements for claiming the home office deduction:

Source: www.balboacapital.com

Source: www.balboacapital.com

Home Office Tax Deduction Guide Balboa Capital, What is the home office tax deduction? The home office deduction lets you deduct a portion of your home expenses to reduce your business taxes owed.

To Qualify For A Home Office Deduction, Your Living Space Must Meet Two Criteria:

The home office deduction lets you deduct a portion of your home expenses to reduce your business taxes owed.

Home Office Expenses May Be Tax.

Fill in the applicable form.